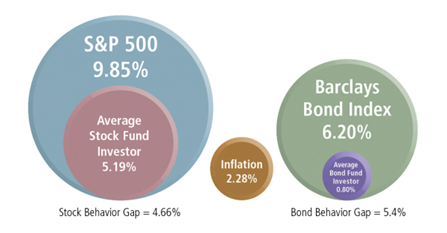

“52% of Americans may be unable to maintain their standard of living when they retire” (BenefitsPro.com 16 Dec. 2014). History has shown that people are lousy investors. There are several factors contributing to the lack of success in investing. A study by Dalbar, Inc. revealed that during the 20-year period from 1995 -2014, the stock market enjoyed an annual return of 9.85% per year. Meanwhile the average investor earned only 5.19% a year. Human emotion pulls investors in different directions and fear and greed are the two biggest hindrances to investment success because they cause investors to lose sight of their long term plans. The markets are ‘noisy’ with so much information being distributed through the media that people don’t know who to trust. In addition, investment fees add up over time and investors have no knowledge of the true costs of their investments. There are both hidden fees as well as those that are outwardly stated. All of these combine to make it difficult for the average investor to create the proper amount of wealth needed for retirement.

The Cost of Emotions

Average Investor vs. Major Indices 1995-2014

Dalbar Inc.

Rather than try to take advantage of the ways markets are mistaken, at MWA, we take advantage of the ways markets are right – the ways they compensate investors. MWA designs its portfolios to capture what the market offers in all its dimensions. Academics are the least conflicted party in finance, at MWA, we rely on their research to guide us in creating prudent, well thought out “proven” investment concepts that deliver the most return for the least amount of expected risk.